What sales effectiveness metrics should you look at if you want to grow your revenue?

That’s the wrong question to ask first because it skips steps.

First, you need to know your company’s go-to-market strategy — how you plan to get the right products to the right people at the right time.

If you know that much, you have the guardrails for which metrics you need to pay the most attention to for your specific business.

Some sales metrics are must-haves — numbers required for accurate reporting. They’re metrics that will change your sales practices, training, and your marketing.

So, what are those sales effectiveness metrics and how do they help your business grow? We’ll answer that and more in this article.

Finally, a sales process that gives you the freedom to sell.

Use Dooly to keep your deals on track, and your manager off your back.

Try Dooly for free

What are sales effectiveness metrics?

Sales effectiveness metrics are the benchmarks used to predict and measure success in sales.

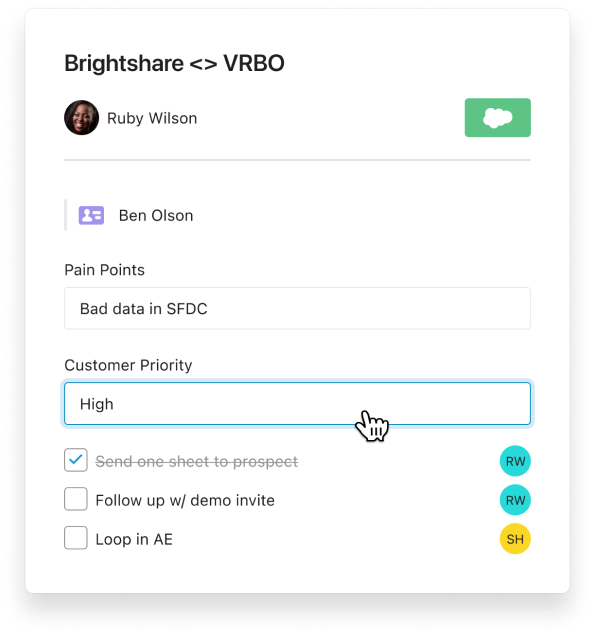

If you’re using Salesforce, you know how easy it is to make sales reports. But maybe you’re measuring the wrong data? Maybe you have too much data to sift through, and can’t make effective decisions because of it.

Make your life a little simpler, and your decisions more effective by paying attention to the metrics that really matter.

Key metrics to measure in Salesforce

Nearly every organization is going to focus on key metrics like:

- Win rate

- Average deal size

- Quota and attainment

- Activity metrics (meetings booked and conversion rates)

- Number of qualified leads

If there’s anything that counts as a key metric, it’d be among those. But saying there’s any one metric that matters more than the rest is a bit of a misnomer, especially since the metrics that matter most to your company will vary depending on your goals and business growth.

Don’t waste your time focusing on too much data

You can’t make decisions easily or quickly if there’s too much data to sift through.

Of course, you want your decisions to be informed, but paring the data down to the essentials is often enough information to make positively impactful decisions.

(Chances are, if you have too much data, you’re not going to do anything with it at all because it’s overwhelming)

You don’t need a lot of data to determine whether or not you’re reaching the right audience.

“I would say that if you need those different data points, or if you want to have them then use an enrichment tool, like a ZoomInfo or something like that, where you can collect those data points where you’re not getting someone from a different department inputting that information.”

Jenna Molby, Marketing Operations Manager

Use your CRM as your single source of truth

If you have your Salesforce set up the way it should be, it’s tied into everything from marketing to sales.

AKA, all of your data and reporting is in Salesforce.

Having all of that information in one place helps you build the reports that are essential to your decision-making without the additional time and effort of figuring out who owns the account, the earnings size, and so on.

Why Salesforce technology isn’t always the answer to your lack of sales volume

All of the data might be in Salesforce, but it’s only able to report on the results of your sales processes.

It can help you identify issues within your sales team, product, processes, but it can’t resolve those issues, obviously.

Salesforce also can’t identify specifically what’s wrong within your processes. If you have a poor sales script, a lack of sales enablement content, or poor playbooks, your sales volume might be suffering.

How to use sales effectiveness metrics

Benjamin Franklin once summed up sales effectiveness by redefining failure.

“I didn’t fail the test, I just found 100 ways to do it wrong.”

Sales effectiveness is your team’s average output, and each individual’s ability to align with your sales goals and strategy. But the process of reaching that effectiveness is organic. A narrowing of what works and what doesn’t.

How you use sales effectiveness metrics is simply a way of cranking up the volume on that natural process, aiding it with hard data that make the next attempt at success more likely to land.

How you might use sales effectiveness metrics:

- As a coaching mechanism

- Identifying your top performing sales reps

- Measuring bottom line profit growth

- Measuring financial trends

To coach your underperformers (and for continuous training)

What is Sally doing that she’s not hitting her quota? What does she need help with? Does she have a difficult sales region? Need peer-to-peer training?

Having the data that specifically points to things like lags in the sales cycle, call volume versus win rates, etc. gives you a look into where exactly sales team performance (and individual performance) lacks.

Translation: more targeted training.

This doesn’t just apply to the individual that isn’t having as much success in closing, but to your entire team.

We know customers can change, and so do their buying habits. This data allows us to see when, where, and how to make adjustments in training that keep everyone on the same page and up to date with what the customer needs and expects.

To identify your top sales performers

Your top salespeople are killin’ it, so why isn’t everyone else?

What are they doing that’s so radically different from everyone else on the team? Granted, there are sales habits and traits that make some people better salespeople than others.

But in most cases, you can train better salesmanship into your reps.

The data will help you see exactly where and why they’re excelling (well, you may need to do a little observation/ listening in on their calls for more detail), to use in training for underperformers.

(Underperforming sales reps might be more receptive to learning from top-performing team members — consider mentorship as a training platform.)

To measure bottom line revenue growth

Revenue is clearly one of those metrics you’re paying attention to… who isn’t, right?

But when you have sales metrics in conjunction with revenue reports, you’re building context around that revenue growth (or lack thereof).

Say, for instance, you changed a sales process or you enforced new sales enablement content. You’re able to see exactly where and how it affected every part of the cycle, customer retention, and bottom-line profitability.

To measure financial trends over time

Looking at any data over time is helpful because it shows how you’re doing.

Are you growing or not?

Are your strategies working?

Is your training helping your reps?

While any of the metrics will tell you whether or not you’re improving, the metrics you pay attention to will vary depending on your goals.

If you’re rolling out a new training program, you’d look at the metrics now for each team member and measure the same again in three months to judge whether or not it was effective. You’ll also see where it was effective and where you need a few more tweaks to boost sales productivity.

Without that data, you’re likely to rely solely on revenue and run a little blind when trying to reach new heights.

Here are the core sales effectiveness metrics every revenue team should consider measuring:

Length of Sales Cycles

The shorter the sales cycle, the faster deals move, opening your reps up to closing even more deals.

Salesforce data shows you just how long the sales cycle is, including the length of each segment. But just seeing it isn’t exactly helpful, because there are a lot of things that could extend each part of the cycle.

Something simple, like the rep not updating their pipeline, may throw off all of the data. When they do an update, it might be hours or weeks later, and you aren’t able to discern that from the data alone (other than seeing the lag).

But say you see a rep who consistently has half a million dollars in the proposals stage. The longer it sits there, the longer the sales cycle extends.

So, of course, you want to see those open opportunities in your reports to know where the rep needs coaching and improve your sales process.

When you get to later stages, like negotiations, you can set up workflow rules and alerts to avoid things like stalling out in the pipeline.

It can be even more important in the beginning stages of your funnel, between the time an inquiry enters the pipeline to the time a rep interacts with that prospect.

Are your average lead response times too long?

The Harvard Business Review conducted a study on lead response times and discovered sales teams that connect with prospects within 5 minutes of their inquiry are 100x more likely to close the deal.

So, yeah, it’s important to keep an eye on that metric.

The longer you take to respond, the less likely you are to close the deal. People want answers at the time of asking, not days or weeks after… when the urgency’s gone.

Review the nature of the customer’s industry

While short sales cycles and higher close rates are ideal, both vary significantly by industry.

Agriculture has a lot of regulations to get through and uphold. It can take 10 years in the pharmaceutical industry for a scientist to go from “let’s create this” to actually hitting the shelves.

Legal ramifications may come into play for several industries and companies. Larger, more established companies may have more bureaucratic systems to push through.

If you don’t take the industry into account while building reports and assessing your sales effectiveness, you might call for training, adjustments, or reprimand where it isn’t called for.

Consider seasonality industry changes

Where are you based? Where are your customers based? There tend to be delays depending on that location and the types of holidays and celebrations that happen there.

Nearly everything in the U.S. slows down for the holidays, business-wise. In Europe, where the standard vacation time is 5 weeks (and most people take that throughout the summer), you’re going to hit lull periods.

At the end of the year, companies are often reassessing their goals and finances and planning for the new year — both will delay your sales.

These nuances may seem obvious, but it’s common to look at a report and wonder why the quarter is slower than the rest without taking this into account.

New Customer Acquisition Cost

Customer acquisition cost (CAC) is the cost spent to acquire a customer. By measuring customer acquisition cost, you have a better understanding of the return on investment for all marketing and sales activities.

To calculate CAC, use this formula:

CAC = (total cost of sales and marketing) / (# of customers acquired)

Of course, if you don’t know what a customer is worth to your company, CAC doesn’t mean much. But once you know LTV (lifetime customer value), you can decide what you’re willing to spend to gain customers.

For instance, venture-led companies often have the capital to spend more upfront to acquire more customers faster, while bootstrapped companies scrutinize CAC out of necessity.

Review your sales benchmarks metrics and compare to actual data

According to Ryan Estis, a sales and leadership consultant and keynote speaker at the KI National Sales Convention, “sales is a series of incremental commitments that hopefully culminates in reaching the finish line…”

Essentially, we break a sales process into touchpoints and the effectiveness of crossing those touchpoints.

- But does the actual data show that we need that many touchpoints?

- Does the actual data show that these customers respond to those touchpoints and really follow that path, or is there a way to shorten it?

- Does your team effectively walk through those touchpoints? Where are they failing or succeeding?

So, reviewing your sales benchmark metrics shouldn’t involve more than just looking at the metrics. You need to look at all of the data to determine A) what your team is doing and what is good for them, and B) what’s good for your business.

You can only bridge the gap between the two when you understand the actual data influencing your benchmarks.

Track monthly acquisition rates per region

If your territory was the northwestern U.S., and the win rate for your territory is typically 20% but in this quarter it dipped below that, you’d want to know why… naturally.

By tracking monthly acquisition per region, you can see how a segment performs in comparison to the rest of the market.

(This is mostly applicable for sales teams using a territory model.

Consider how competitive a given market is

If you are using a territory model, then there are likely factors that’ll play into how well sales do in that region.

For instance, if your company sells, say… air conditioning, you’re unlikely to have consistent customer needs across the country. Portland may have had that spike in heat this summer, but that’s a bit rare.

Florida, on the other hand…

Are your sales goals too unrealistic?

Are you setting goals that are easier for them to hit? Too hard to hit?

Data from RepVue points to the reality that you are. After a survey of 988 sales teams at 435 organizations, they discovered only 31 have 75% or more of their sales team hitting quota over a year long period.

Narrowing that down, that’s really only 3% of sales teams hitting close to quota.

That’s pretty significant, and it means your team is likely falling into that same rut. If only one or two of your reps can consistently meet quota each quarter or year, reevaluate your sales processes (or at least your quotas).

First step: do a deep dive and try to understand what they’re facing.

Customer Attrition Rate

Customer attrition has more to do with the post-sale side of things than anything else — the customer success and support.

Clearly, you don’t want to have a high churn rate, so it’s something you have to pay attention to.

Salesforce will give you those numbers, but look at the relation to other parts of the funnel. How long did it take to close that customer? What was the lead time? Their objections?

All of this could play into the attrition rate.

What is a customer attrition rate?

Customer attrition rate is, simply put, the number of customers you don’t retain within any given time period (usually expressed as a percentage).

To calculate customer attrition rate:

CCR = (Y / X) x 100

X= the number of customers lost

Y= the number of customers at the beginning of the assessed period

Consider how customer attrition rate varies industry to industry

This is another area that will vary greatly depending on your industry. Naturally, some industries are going to be better at adopting certain technologies, understanding if they have the right fit before purchase, understanding their needs, etc.

Or maybe your business model revolved around solo purchases — like e-commerce.

Also, take into account that people are more likely to buy again from customers that are loyal to a brand. Don’t establish trust before a purchase? Don’t expect them to stick around.

Statista has a pretty good breakdown of the churn rates across industries and why it needs to be a considered factor when you’re setting goals and building sales reports:

Here are the average churn rates for every industry:

General retail: 24%

Online retail: 22%

Financial: 25%

Telecommunications: 21%

Travel: 18%

Big box electronics: 11%

Cable: 25%

SaaS: 4.79%

Review your customer churn rates

The average churn rate for the SaaS industry rests at 4.79%, though, depending on the industry, churn rate could be as high as 17% (at Dooly, we’re at just 2%).

While it’s always a good idea to measure how you stack up against other Saas companies, you should put even more emphasis on why you’re performing well or underperforming in comparison.

If you have a low churn, your product is more aligned with the problems you’re solving, but also goes beyond that to encompass the adoption of that technology and the support they get as a customer.

On the other hand, if you’re a new business, your churn might be high while you’re narrowing down your ideal customer.

Churn, whether voluntary or involuntary, relates directly to the entire package — every interaction they have with your company (not just their purchase). So if you’re trying to lower your churn, you can’t just create a better product or focus on selling to more ideal customers. You have to take everything into account.

There is another reason to measure churn, besides to reduce it and keep more of your customers, and that is: to understand your net revenue retention (NRR).

The equation to calculate net revenue retention:

Net Revenue Retention = (Monthly Recurring Revenue (MRR) at Start of Month + Expansions + Upsells – Churn – Contraction)/ MRR at Start of Month

If churn numbers are low, and growth numbers high, you’ll end up with great NRR numbers. Anything over 100% puts you at the higher end of performance for your industry (standard industry median for SaaS NRR is 100%. Dooly sits at 140%, woohoo).

Salesforce Effectiveness (Adopting Technology to Boost Your Sales)

While we so often think of Salesforce (the software) for its basic productivity and sales process streamlining, we forget that it’s aptly named for the purpose of boosting sales force effectiveness.

Nearly every sales team uses Salesforce, but underutilizes it for that intrinsic boosting power, because of failed adoption.

Why does most Salesforce adoption fail?

Money and time. That’s the problem with adoption for nearly anything else in life too, and just like everything else, it costs you just as much, if not more, to not devote that time and money.

You may devote a lot of time to building the processes within Salesforce, and because of that, you feel like implementation is going to be easy. But it isn’t, and that’s when the failure sets in and affects your entire team, and your company’s bottom line.

How to properly adopt Salesforce for better sales effectiveness?

Andrew Fragias, a Product Manager at Validity, during an interview with Salesforce consultant David Giller, makes the point that Salesforce adoption requires proper expectations.

“User adoption is probably one of the biggest hurdles… what is making this issue the hardest is the lack of concept of the champion. Some to champion your product… on top of that you have a whole bunch of users so used to their legacy system that it’s very hard to change the way they work…

Take for example myself. I worked on the Microsoft office desktop app, then all of a sudden, on day it wasn’t working on my computer. I had to switch to the online version. I’m so hesitant of it, so I try to get IT to fix the desktop version. But now I’m using the online version every day. I found something different. But going back to that point, you have a lot of users that just don’t want to make the switch. Or, they expect Salesforce to do everything their old system does. You’re never going to get there, unless you spend the best of 10 years customizing the system to get there.”

How do you get around these issues for better Salesforce adoption (and subsequently better sales effectiveness)?

On another Brainiate episode, Paul Ginsberg addresses this with these solutions:

- Consider the needs of the actual Salesforce user. It’s not about how it makes your life easier, it’s how it makes theirs easier.

- Shift the mindset from the CRM as a data repository to a single source of truth. Keeping too many data silos between teams means you may end up with things like duplicate records.

- When the data within Salesforce is really poor, users don’t really feel its valuable to them, so they’re less likely to use it. This is why you need both great migration from a legacy system and a data advocate within your organization.

- Provide training to the people that actually use Salesforce within your company. It’s an incredibly complex tool with a lot of data. Without proper training, it’s impossible to have accurate data.

- On that note, you need some tech support as well. You most likely have at least one application connected to Salesforce, and if it’s not correctly integrated, or if there’s an issue, you’ll have inaccurate data.

- Adoption is a matter of slipping seemlessly into regular tasks and routines. Occassionally, CEOs and execs get shiny object syndrome and add a new technology without really learning how it works with their team. It’s best to find something that either works with current routines, or to slowly and steadily change routines (much more difficult).

Your team likely uses Salesforce, but it’s also just as likely you don’t have proper adhesion, and that’s killing your productivity and leading to inaccurate Salesforce effectiveness metric data.

Essentially, you can’t boost your sales processes and your team without proper data. You can’t get proper data if you don’t have proper adoption to your sales effectiveness technology.

So if there were one place to start on your journey, before you even start looking at who your top performers are and why you have underperformers, look at your adoption first. Do you actually have it?

The easiest way to improve Salesforce adoption? Dooly. Top revenue teams like Asana, Figma, and Intercom use Dooly to capture 60%+ more deal data in Salesforce with adoption that scales as fast as they do. See Dooly in action.

Join the thousands of top-performing salespeople who use Dooly every day to stay more organized, instantly update their pipeline, and spend more time selling instead of mindless admin work. Try Dooly free, no credit card required. Or, Request a demo to speak with a Dooly product expert right now.